Employers’ policies may provide for accumulated rights that carry forward to future periods if they are not used in the current period. They may also provide for vested rights that create an obligation to pay for compensated absences even after terminating employment. Companies should take care that their policies are consistent with state and local regulations.

Factor in Employee Salaries

If the total liability is material, then it should be reported separately or disclosed in the notes to the financial statements. This entry records the vacation expense and the accrued vacation as a liability on the company’s balance sheet. Vacation accrual is the incremental accumulation of time off (usually paid time off or PTO) that an employee earns while working at your company.

Accounting for Vacation Accrual

Here’s what you need to cover, including accrual calculations, journal entries, and the impact of raises and sabbaticals. For instance, assuming the company ABC Ltd. recorded the $8,320 of total accrued vacation during the period but the actual payment of vacation was $8,500. Using the example about calculating vacation accrual, find out how to record journal entries. Cash is an asset account, which increases by a debit and decreases by a credit. You will decrease your Cash account since an employee is using or cashing out their vacation time.

How to Calculate Accrued Vacation Pay

In this journal entry, the $180 of vacation expense would be in a different period from the period it actually incurred. However, as the accrued vacation is an accounting estimate and the amount is only $180, there is no need to adjust it in the previous period. In this journal entry, the expense increases (debit) to record the cost that incurs as the employees have worked for the period. On the other hand, the liability also increases (credit) to recognize the payment obligation that the company needs to fulfill at the end of the period. After you calculate the vacation time accrued for each employee, you will need to record them in your business’s books. Be sure to record vacation accrued at the end of your accounting period.

Managing time off requests is a key part of managing vacation accruals — when someone takes a holiday, you want their PTO balance updated. Now that you have accurate time keeping, you’ll need to be able to set up rules based on how these employees accrue vacation time. Accrual and allotment are two approaches for distributing PTO to employees, but both deal with the total hours of vacation time an employee has. Of course, there are cases where you won’t have to pay for accrued vacation. For example, you won’t have to accrue vacation pay if you have a use it or lose it policy.

Unlimited Vacation Policies

- Studies show that during the COVID-19 pandemic, employees on average worked longer hours from home than in the past, essentially converting commuting time into additional work time.

- Understanding the relevant accounting standards ensures accurate financial reporting and helps you avoid potential legal issues.

- You look over the lease and realize it doesn’t actually specify how the landlord would like to get paid or where to send the money.

- Consider exploring FinOptimal’s managed accounting services for assistance with these calculations and ensuring accurate financial statements.

- I’ve added some articles about adding the appropriate accruals to your payroll system and updates for sick and vacation pay.

- For internal control purposes, many companies have mandatory vacation periods — these obviously would need to be taken within the required time frames.

So accrued expenses are a payable account that is a liability on your balance sheet. The answer is prepaid expenses, and they’re actually more common than you think. Let’s assume that a company has a formal agreement that provides its employees with 120 hours of paid vacation in the year following the employees’ full-time employment.

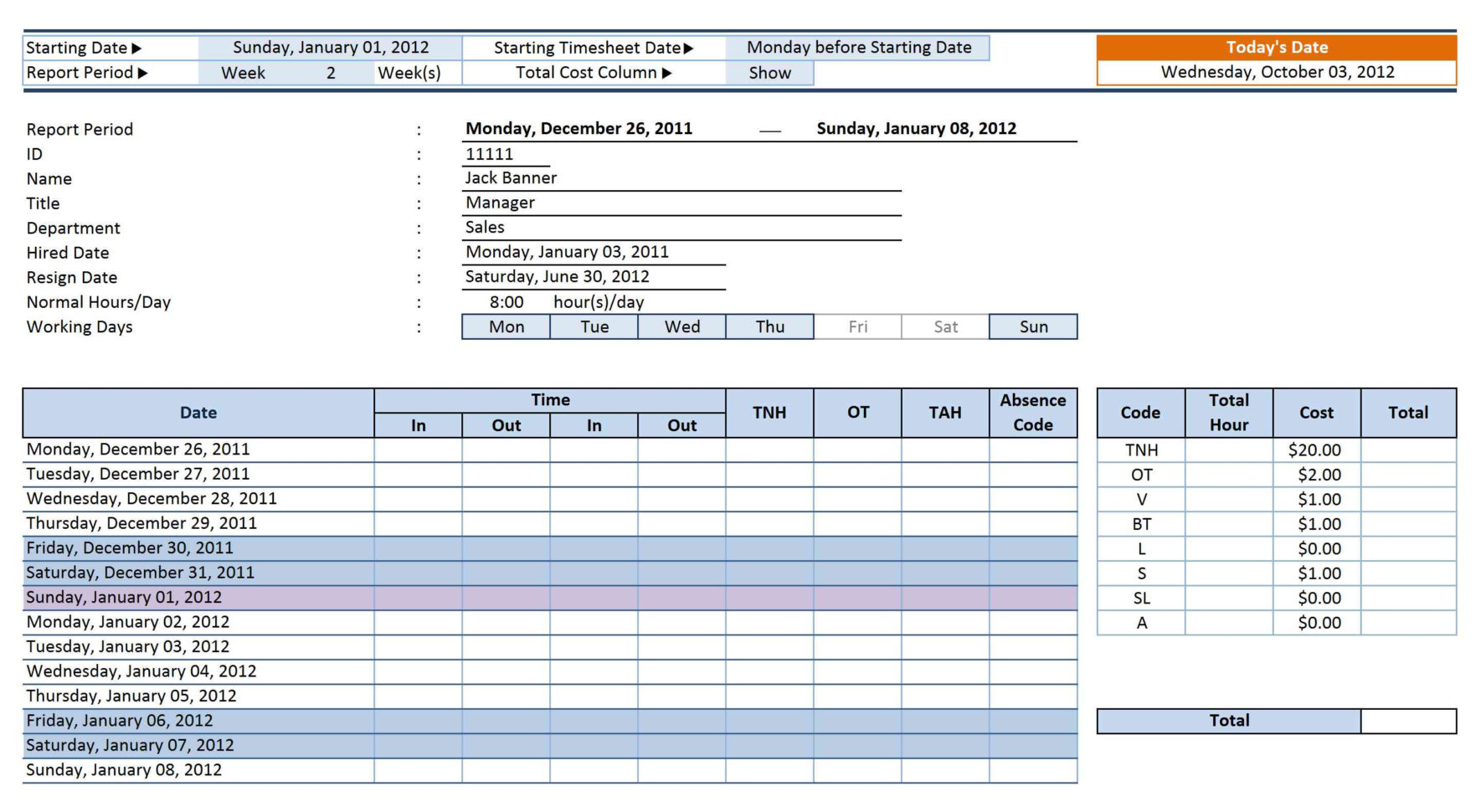

I am working out closing the year-end and I’ve calculated my employee’s accrued and used vacation amounts. I need to make journal entries to show accrued, unused vacation as a liability, but am unsure of what accounts to debit/credit. I do have my payroll items mapping Vacation hours employees have used to an expense account, so I am able to see how many vacation hours were paid out. The value of the vacation accrual is based on the amount of earned but unused vacation time and the employee’s compensation rate. Bob, an employee of ABC Co., earned 10 days of vacation during Year 1, used 5 days during the year and had 5 vacation days left at the end of the year.

In this case, the company can make the journal entry by debiting vacation payable account and crediting cash account. A vacation accrual policy are the guidelines that an employer creates as to how employees earn PTO over a period of time. Vacation accrual is a way to ensure that employees are able to take time away from their place of work when needed.

Many employers provide vacation time to employees, but employees might not use their earned vacation right away. When employees have accrued vacation time, you must create a vacation accrual journal entry. Read on to understand the basics of vacation accrual and how to calculate and record accrued vacation in your books. Traditional capped policies create a clear liability that needs to be tracked and reported on the balance sheet.

For more advanced automation solutions, explore FinOptimal’s Accruer software. Accrued vacation time represents a real cost for businesses, and tracking and accounting for it correctly is crucial. Understanding the relevant accounting standards ensures accurate financial reporting and helps you avoid potential legal issues. Some businesses prefer a monthly approach, aligning it with other regular accounting tasks. Others find a quarterly approach more manageable, balancing accuracy and efficiency. Smaller businesses, with less frequent payroll changes, often favor an annual approach.