Analysts and investors often compare a company’s most recent ratio to historical ratios, ratio values from peer companies, or average ratios for the company’s industry. The ratio is commonly used as a metric in manufacturing industries that make substantial purchases of PP&E to increase output. Investors monitor this ratio in subsequent years to see if the company’s new fixed assets reward it with increased sales. Average total assets are usually calculated by adding the beginning and ending total asset balances together and dividing by two. A more in-depth, weighted average calculation can be used, but it is not necessary. There is no single number that represents a good total asset turnover ratio, because each industry has different business models.

Total Asset Turnover Ratio Formula

A low total asset turnover means that the company is less efficient in using its asset to generate revenue. So, what makes a good asset turnover ratio for your business isn’t necessarily the same as your neighbor’s. In fact, every industry has its own benchmarks, and you’ll want to check yours to see if you’re getting the most out of your assets. Since your asset turnover ratio is typically accounts payable solutions only measured once per year, you’ll have to understand that large purchases, even if they were made months ago, can easily skew your current ratio. So, you might find that your asset turnover ratio isn’t a totally accurate reflection of your current efficiency. Target’s low turnover may also mean that the company may have a long collection period which results in higher accounts receivable.

How to Analyze Asset Turnover Ratio by Industry

- The asset turnover ratio helps investors understand how effectively companies are using their assets to generate sales.

- Such ratios should be viewed as indicators of internal or competitive advantages (e.g., management asset management) rather than being interpreted at face value without further inquiry.

- As a company’s total revenue is increasing, the asset turnover ratio can identify whether the company is becoming more or less efficient at using its assets effectively to generate profits.

- Thus, a sustainable balance must be struck between being efficient while also spending enough to be at the forefront of any new industry shifts.

For example, retail companies have high sales and low assets, hence will have a high total asset turnover. On the other hand, Telecommunications, Media & Technology (TMT) may have a low total asset turnover due to their high asset base. Thus, it is important to compare the total asset turnover against a company’s peers. A high total asset turnover means that the company is able to generate more revenue per unit asset. On the other hand, a low total asset turnover suggests that the company is unable to generate satisfactory results with the asset it has in hand.

Asset Turnover Ratio Interpretation and Examples

While investors may use the asset turnover ratio to compare similar stocks, the metric does not provide all of the details that would be helpful for stock analysis. A company’s asset turnover ratio in any single year may differ substantially from previous or subsequent years. Investors should review the trend in the asset turnover ratio over time to determine whether asset usage is improving or deteriorating. Although there’s no single key to a successful business, it’s often the business owners who’ve figured out how to run a lean business that enjoy long, prosperous futures. Your asset turnover ratio will help you—and your business accountant— understand whether or not your business is running efficiently and, subsequently, whether you’re setting it up for success. It signifies that the company generates more than a dollar of revenue for every dollar invested in assets.

Low asset turnover ratio interpretation

The asset turnover ratio can also be analyzed by tracking the ratio for a single company over time. As the company grows, the asset turnover ratio measures how efficiently the company is expanding over time; especially compared to the rest of the market. Although a company’s total revenue may be increasing, the asset turnover ratio can identify whether that company is becoming more or less efficient at using its assets effectively to generate profits. On the other hand, if a company’s industry has an asset turnover that is greater than 1 and the company’s ratio is 0.9; then the company is not doing well. In this case, a lower asset turnover ratio indicates that the company may not be using its assets efficiently.

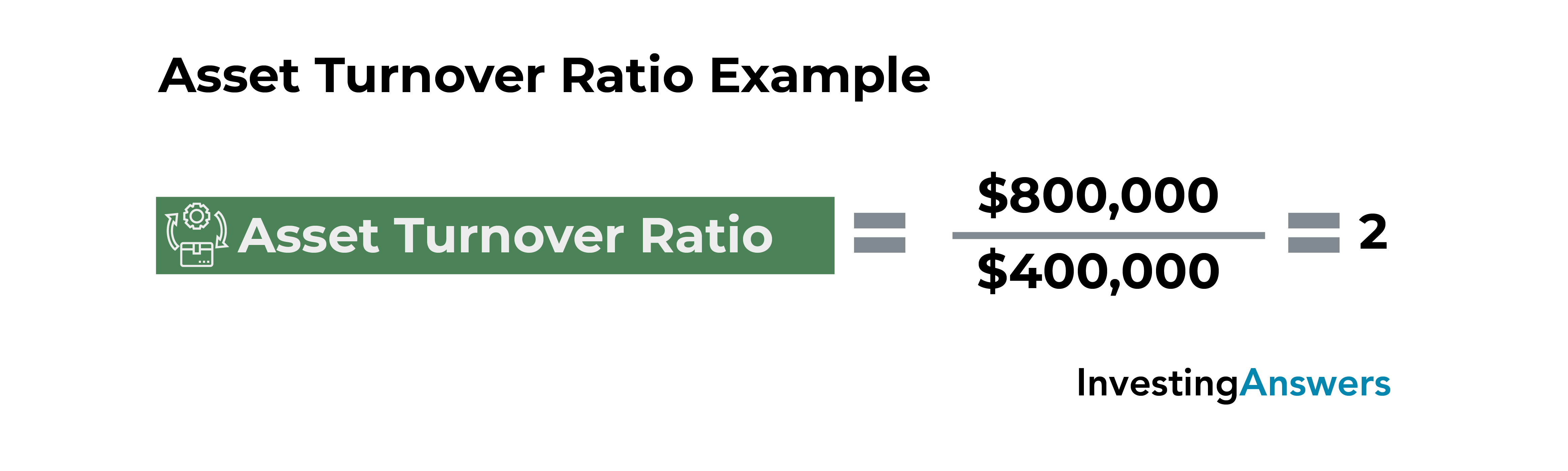

The Asset Turnover Ratio is calculated by dividing the company’s revenue by its average total assets during a certain period. The asset turnover ratio is an efficiency ratio that measures a company’s ability to generate sales from its assets by comparing net sales with average total assets. In other words, this ratio shows how efficiently a company can use its assets to generate sales. The fixed asset turnover ratio is useful in determining whether a company uses its fixed assets to drive net sales efficiently. It is calculated by dividing net sales by the average balance of fixed assets of a period.

To reach this number, you’ll need (unsurprisingly) two years of asset totals; you can find this information on your accounting balance sheet. Once you have your current year number and your previous number, add them up and divide them by two for the average. We’ll show you how to calculate the asset turnover ratio equation, and why it’s important to understand this accounting term. As we can see from the calculation done, Walmart and Target both had an asset turnover ratio that is greater than one.

The asset turnover ratio is calculated by dividing revenue by average total assets, and revenue is always a positive number. Asset turnover (total asset turnover) is a financial ratio that measures the efficiency of a company’s use of its assets to product sales. It is a measure of how efficiently management is using the assets at its disposal to promote sales. The asset turnover ratio is calculated by dividing the net sales of a company by the average balance of the total assets belonging to the company. It would not make sense to compare the asset turnover ratios for Walmart and AT&T, since they operate in different industries. Comparing the relative asset turnover ratios for AT&T with Verizon may provide a better estimate of which company is using assets more efficiently in that sector.

In other words, the company is generating 1 dollar of sales for every dollar invested in assets. The asset turnover ratio is used to evaluate how efficiently a company is using its assets to drive sales. It can be used to compare how a company is performing compared to its competitors, the rest of the industry, or its past performance.