As illustrated by these journal entries, while the initial entry to record accrued vacation increases expense on your profit and loss statement, future uses of accrued vacation do not. The Financial Accounting Standards Board (FASB) provides the generally accepted accounting principles (GAAP) that guide accounting practices in the US. Specifically, ASC 710, Compensation—General, deals with compensated absences, including accrued vacation time.

How to Record a Vacation Accrual Journal Entry

You’re actually prepaying for the full twelve months of service, and your accounting can reflect that. To illustrate this, let’s say an employee of yours is purchasing supplies for a staff party in June, for which they’ll be reimbursed on their July paycheck. Your accounting method determines in which month the expenses are recorded. These short-term or current liabilities can be found on your company’s balance sheet and general ledger. Depending on your accounting system and accountant, they might also be called accrued liabilities or spontaneous liabilities. An accrued expense is an expense that has been incurred within an accounting period but not yet paid for.

Accounting for Vacation Accrual

Vacation accrual can also help to reduce stress levels for employees by allowing them the opportunity to take a break from their work. An employee takes 5 days of vacation in January 2025, equivalent to $2,000 of previously accrued vacation. When adding in vacation accrual, you will debit your Vacation Expense account and credit your Vacation Payable account.

Pushing the Boundaries of Finance: How Pushkin Industries Revolutionized Their Accounting with FinOptimal

You only record accrued expenses in your books if you run your business under the accrual basis of accounting. Here we’ll go over what exactly accrued expenses are, how to account for them using journal entries, and what they mean for your bookkeeping and accounting operation. Each employee is entitled to 12 vacation days per year, accruing one day per month. The company’s policy allows employees to carry over unused vacation days to the next year. When examining vacation accrual systems, you’ll want one that is customizable for your needs. Buddy Punch allows managers to customize vacation accrual with a range of options.

If the company finds overstated vacation accrual by $500 at the end of the prior year, it needs to adjust the liability. After a stint in equity research, he switched to writing for B2B brands full-time. Arjun has since written for investment firms, consultants, and SaaS brands in the Accounting and Finance space.

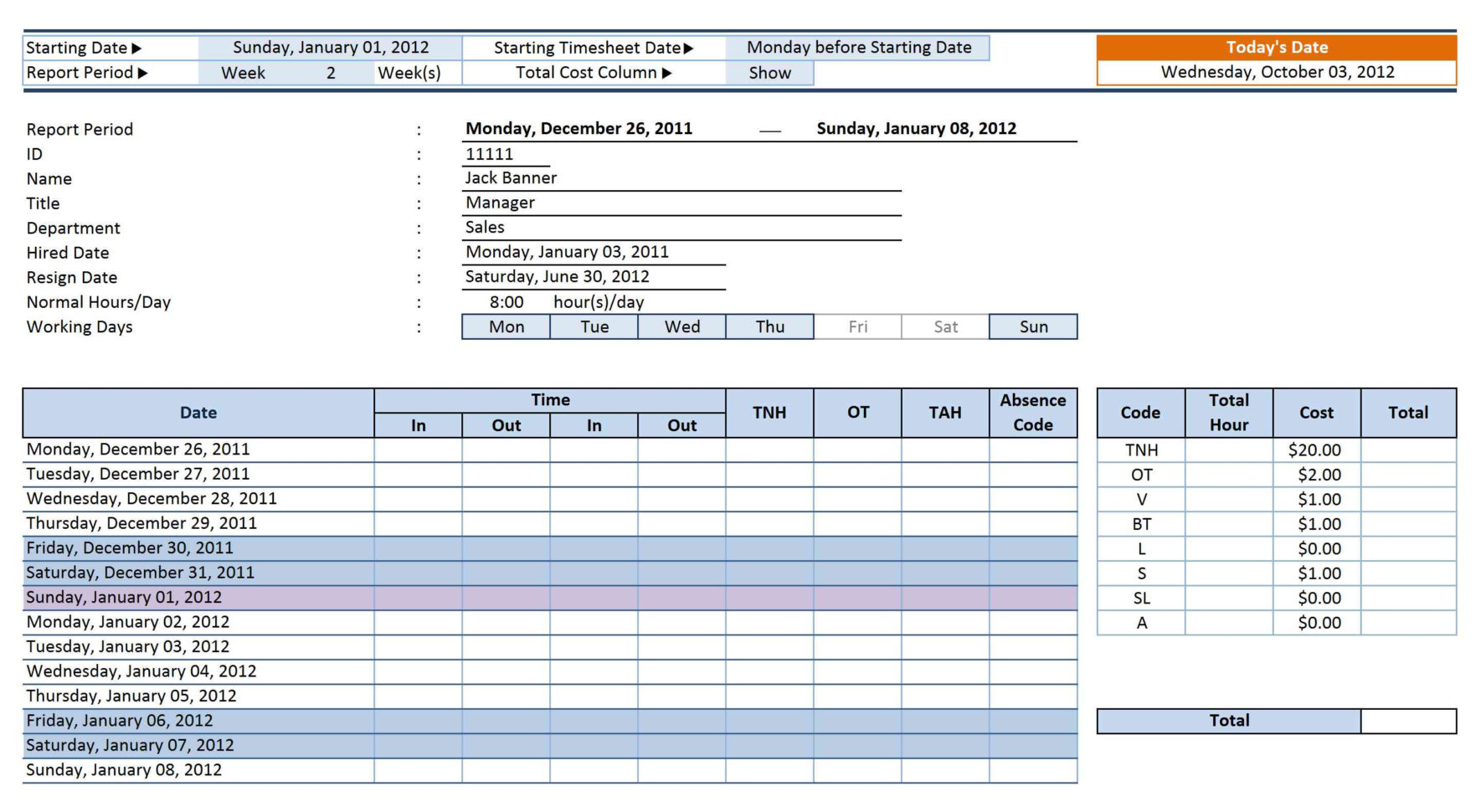

Free & Downloadable Construction Timesheet Templates

- Discover the nuances of the sector and evaluate 8 tailored accounting options.

- Think of it as a running tally of time off they’ve banked, ready to be enjoyed.

- Both of these can adversely affect vacation accrual by leading to inflated or inaccurately tracked timesheets.

- I also explain how raises and sabbaticals impact accrued vacation pay.

- Whether you’re a seasoned financial professional or just starting out, this guide will equip you with the knowledge you need to manage accrued vacation effectively.

Fred is paid $30 per hour, so his total vacation accrual should be $1,260 (42 hours x $30/hour). The beginning balance for him is $1,200 (40 hours x $30/hour), so ABC accrues an additional $60 of vacation liability. As they work, most employees earn the right to take days off for a variety of reasons, including vacation, illness, personal care, and family time.

To make sure you’re not adding more tasks to your to-do list like having to check up on it and manually post, you want to invest in a social media management tool. You find one you like, and their pricing page mentions you can save a lot of money by being billed annually. Instead of paying $140 every month, you are billed $1,200 for the full year saving you almost $500. You now carry $3,000 in accrued expenses on your books to reflect the $3,000 you owe the landlord. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

Exhibit 6 provides a footnote disclosure by The Davey Tree Expert Company that includes accrued compensated absences as one item comprising accrued expenses. Using the accrual method, you would record a loss of $2,000 for the vacation accrual journal entry reporting period ($2,000 in income minus $4,000 in accounts payable). In our example, the company has only the one full-time employee, so the company’s December 31 balance sheet must report a current liability of $3,120.